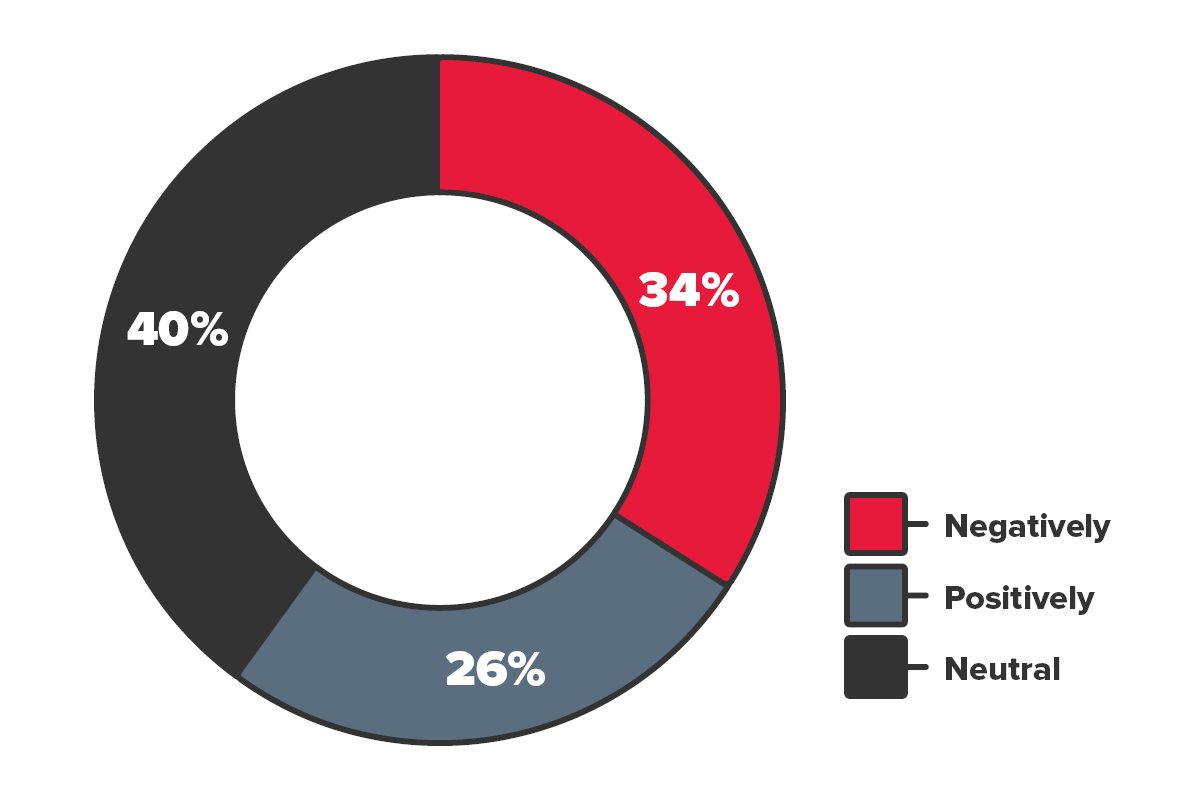

Compared with a year ago, how are you feeling about your personal financial situation?

- Negatively – 34%

- Positively – 26%

- Neutral – 40%

Source: On behalf of CPA Canada and BDO Debt Solutions (Licensed Insolvency Trustees), Leger conducted the Economic uncertainty OMNIbus online survey from February 7 to February 10, 2025.