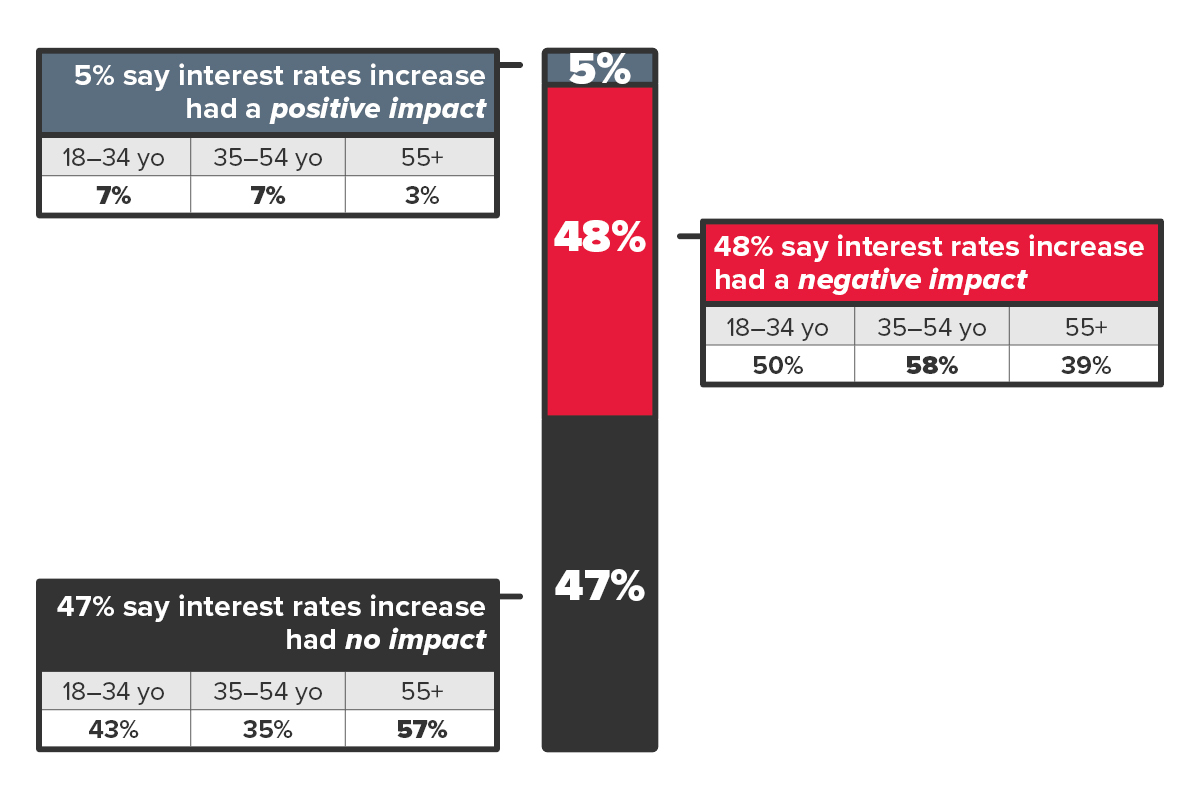

To what extent have the interest rate increases of the last few years (2022-2023) impacted your debt load?

5% say interest rates increase had a positive impact

- 18-34 yo – 7%

- 35-54 yo – 7%

- 55+ – 3%

48% say interest rates increase had a negative impact

- 18-34 yo – 50%

- 35-54 yo – 58%

- 55+ – 39%

47% say interest rates increase had no impact

- 18-34 yo – 43%

- 35-54 yo – 35%

- 55+ – 57%

Source: On behalf of CPA Canada and BDO Debt Solutions (Licensed Insolvency Trustees), Leger conducted the Impact of Interest Rates on Canadians’ Personal Finances OMNIbus online survey from June 28 to July 2, 2024.