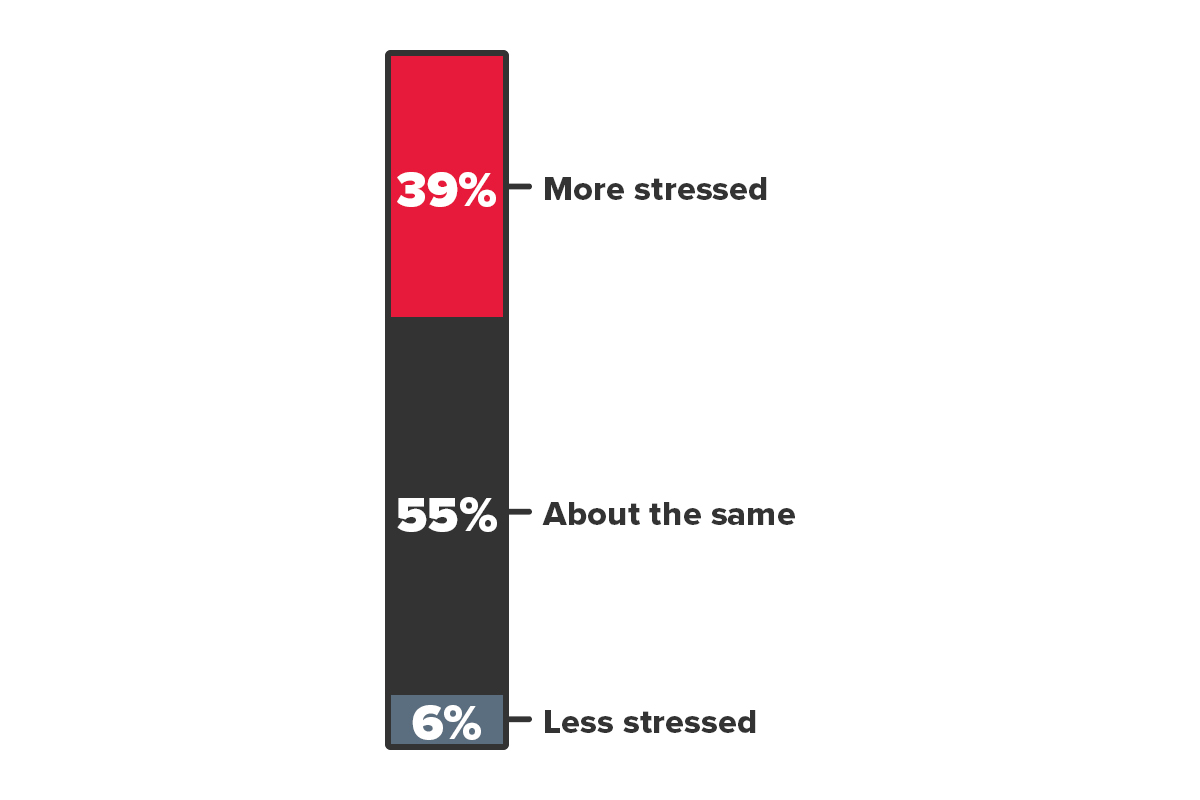

Compared to last year, how stressed are you feeling about your spending heading into the holiday season?

39% – More stressed

55% – About the same

6% – Less stressed

Source: On behalf of CPA Canada and BDO Debt Solutions (Licensed Insolvency Trustees), Leger conducted the 2024 Holiday Spending OMNIbus online survey from September 27 to September 29, 2024, among 1,626 randomly selected Canadians aged 18 and over.