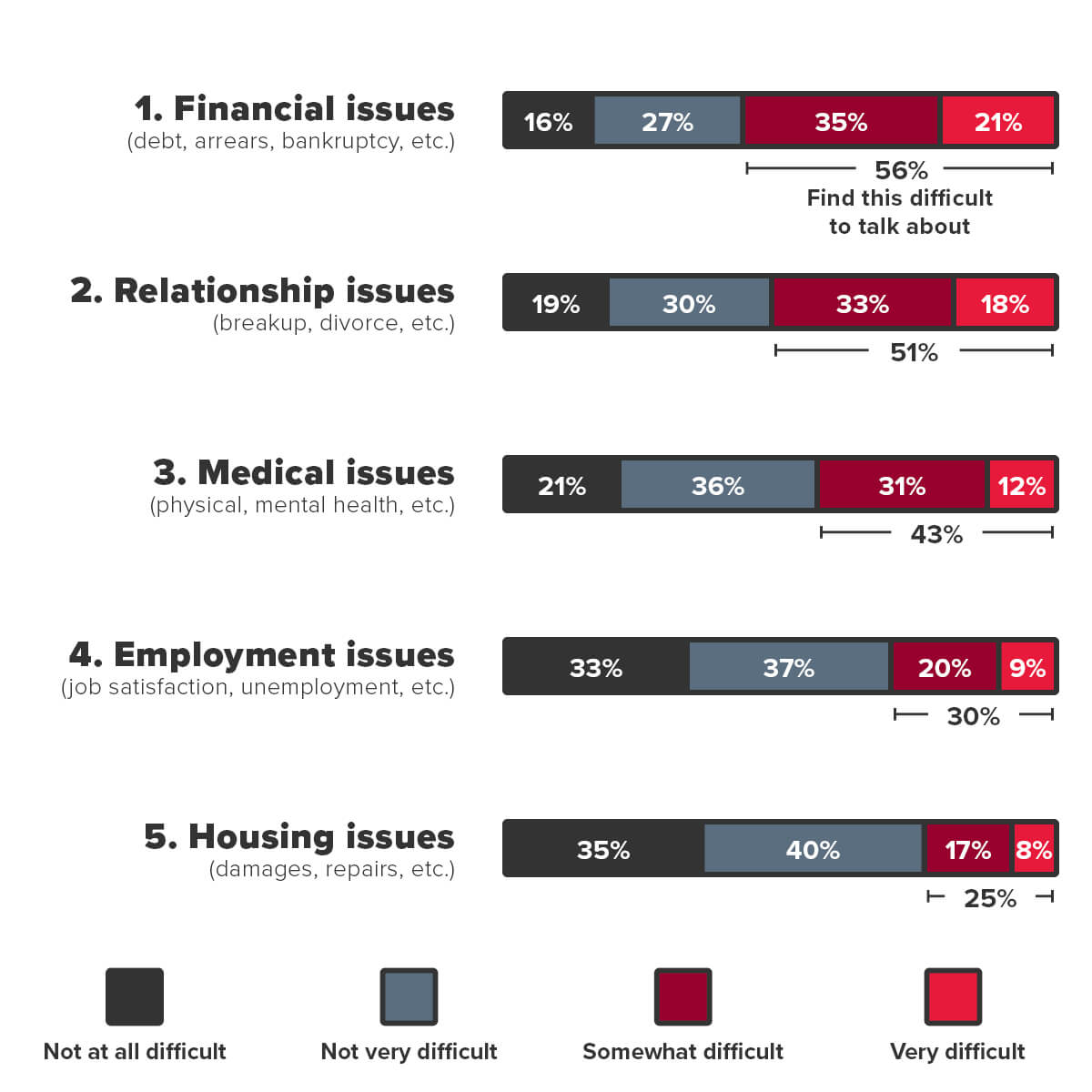

- 21% - Very difficult

- 35% - Somewhat difficult

- 27% - Not very difficult

- 16% - Not at all difficult

- 18% - Very difficult

- 33% - Somewhat difficult

- 30% - Not very difficult

- 19% - Not at all difficult

- 12% - Very difficult

- 31% - Somewhat difficult

- 36% - Not very difficult

- 21% - Not at all difficult

- 9% - Very difficult

- 20% - Somewhat difficult

- 37% - Not very difficult

- 33% - Not at all difficult

- 8% - Very difficult

- 17% - Somewhat difficult

- 40% - Not very difficult

- 35% - Not at all difficult