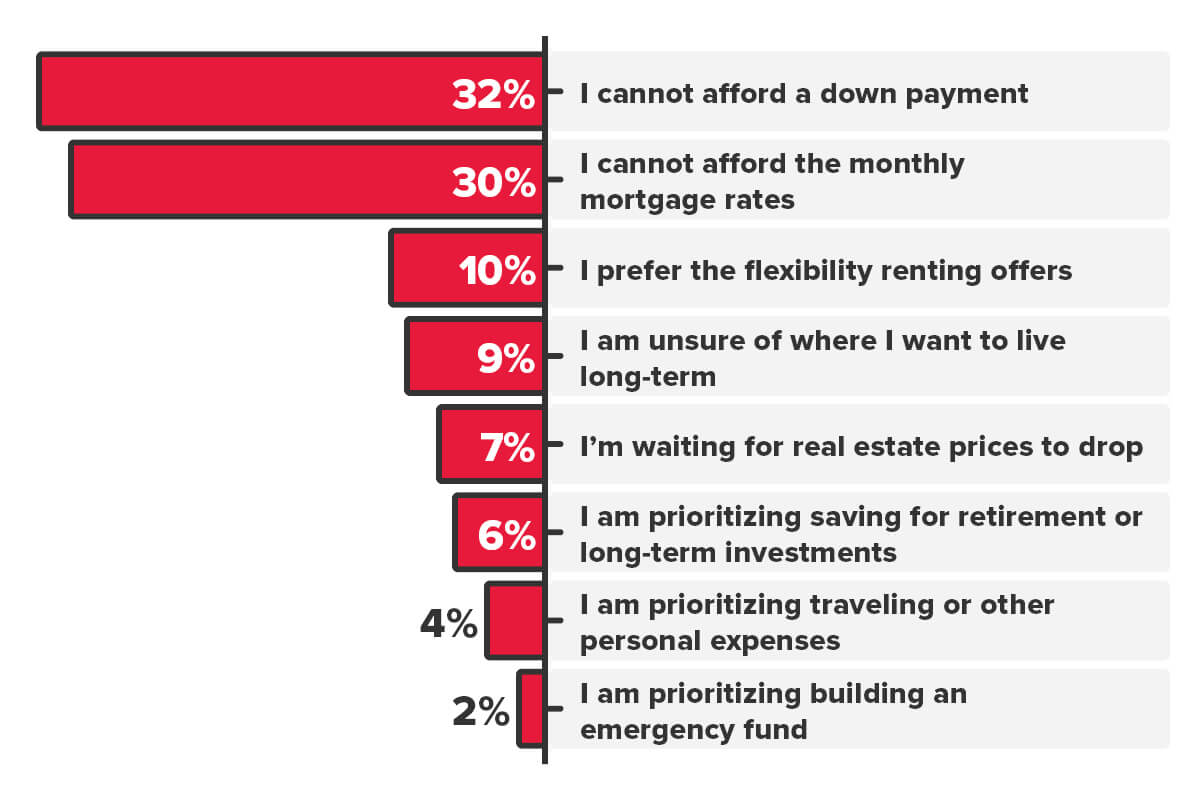

What is the main reason you do not currently own a home?

- I cannot afford a down payment – 32%

- I cannot afford the monthly mortgage rates – 30%

- I prefer the flexibility renting offers – 10%

- I am unsure of where I want to live long-term – 9%

- I prefer the flexibility renting offers – 7%

- I am prioritizing saving for retirement or long-term investments – 6%

- I am prioritizing traveling or other personal expenses – 4%

- I am prioritizing building an emergency fund – 2%

Source: On behalf of CPA Canada and BDO Debt Solutions (Licensed Insolvency Trustees), Leger conducted the Housing Market OMNIbus online survey from February 7 to February 10, 2025.