It’s hard to get out of debt in 2023.

Housing, groceries, and borrowing costs have all increased with inflation and rising interest rates.

We asked Canadians how they’re managing debt and what they’re doing to weather the affordability crisis.

Here’s what they told us.

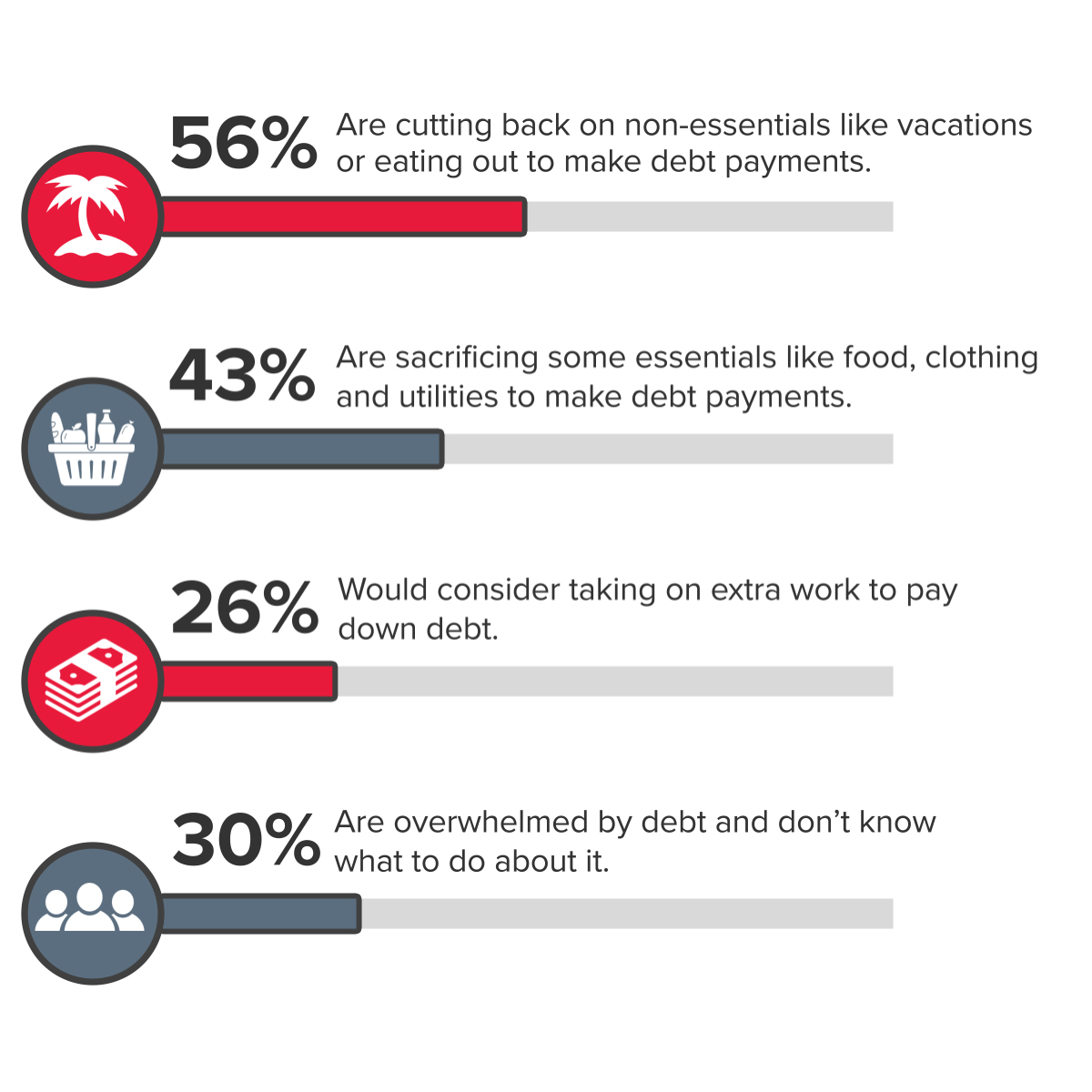

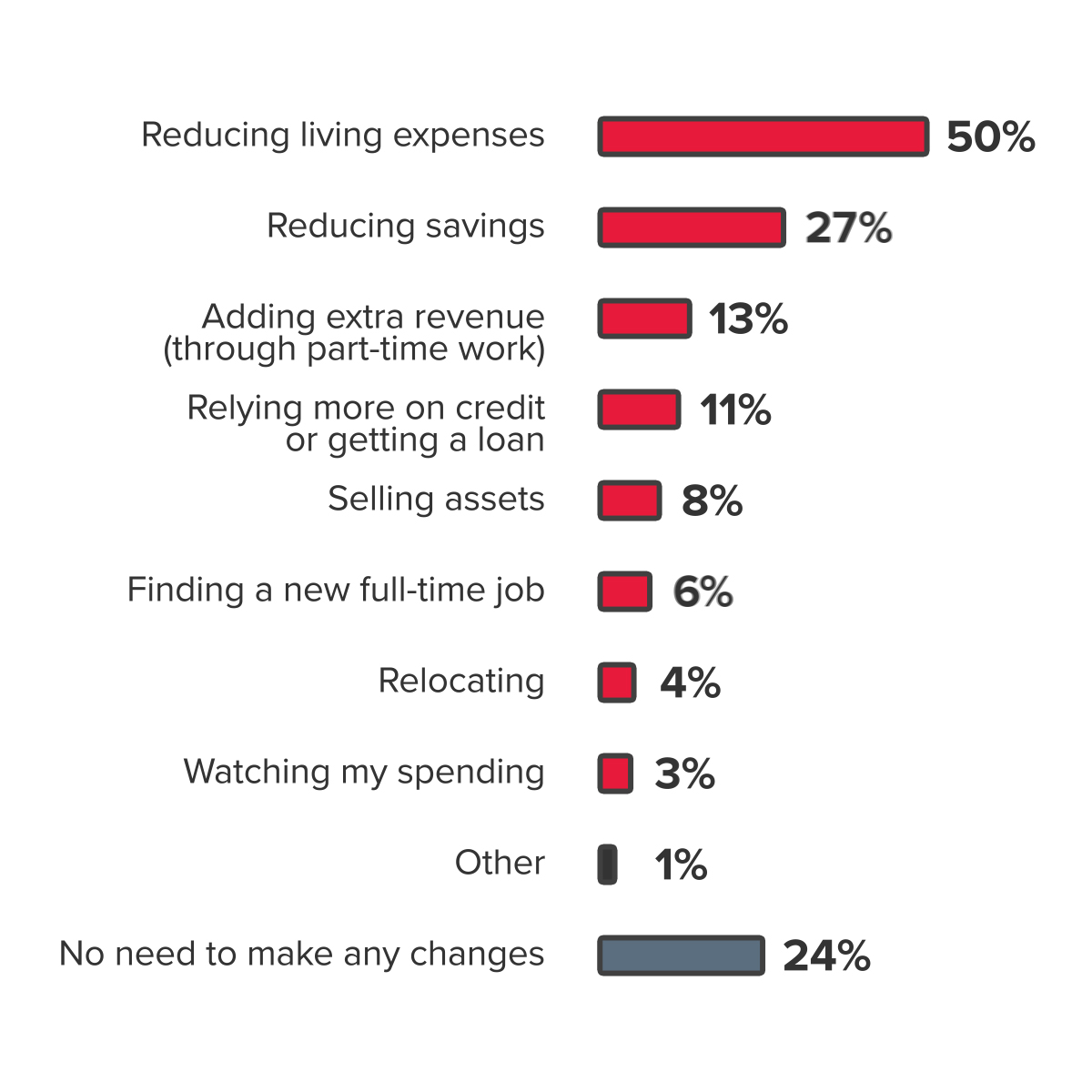

Managing debt becomes even more difficult when expenses are at an all-time high. Affordability has reached a crisis point and Canadians are trying different things to cope.

Quebecers are the most likely to say they are reducing their living expenses (62%) to cope with inflation, and those in BC are the least likely (40%). But the reverse can be said about reducing savings. Fewer Quebecers (20%) are reducing savings to cope with rising costs compared to residents of BC (40%).

Canadians aged 18-34 and residents of BC are the most likely (16%) to take on more credit to get by.

"One of the best ways to cope with inflation is to downsize expenses. Reduce non-essential spending and adapt to the current climate. Taking on debt or reducing savings to keep the status quo can have long-lasting consequences."

Nancy Snedden, Licensed Insolvency Trustee & President of BDO Debt Solutions

To get out of debt, you need to look at your whole financial picture, explore ALL your options, and choose the right set of solutions for you. This looks different for every household. Not everyone has the ability to take on extra work, and sometimes many people have already cut back as much as they can.

The key is to face your full financial reality, be realistic and focus on moving forward.

![]()

Every good financial decision starts with a budget. A budget will help you to:

Improving the way you manage your debt can help you make ends meet, free up extra resources, and help you start planning for the future.

Explore all your available options.

Giving yourself a plan. Look at our calculator.

Can you earn more money? Can you diversify your revenue streams? Every little bit helps, and it can help bolster your savings and debt repayment plans.

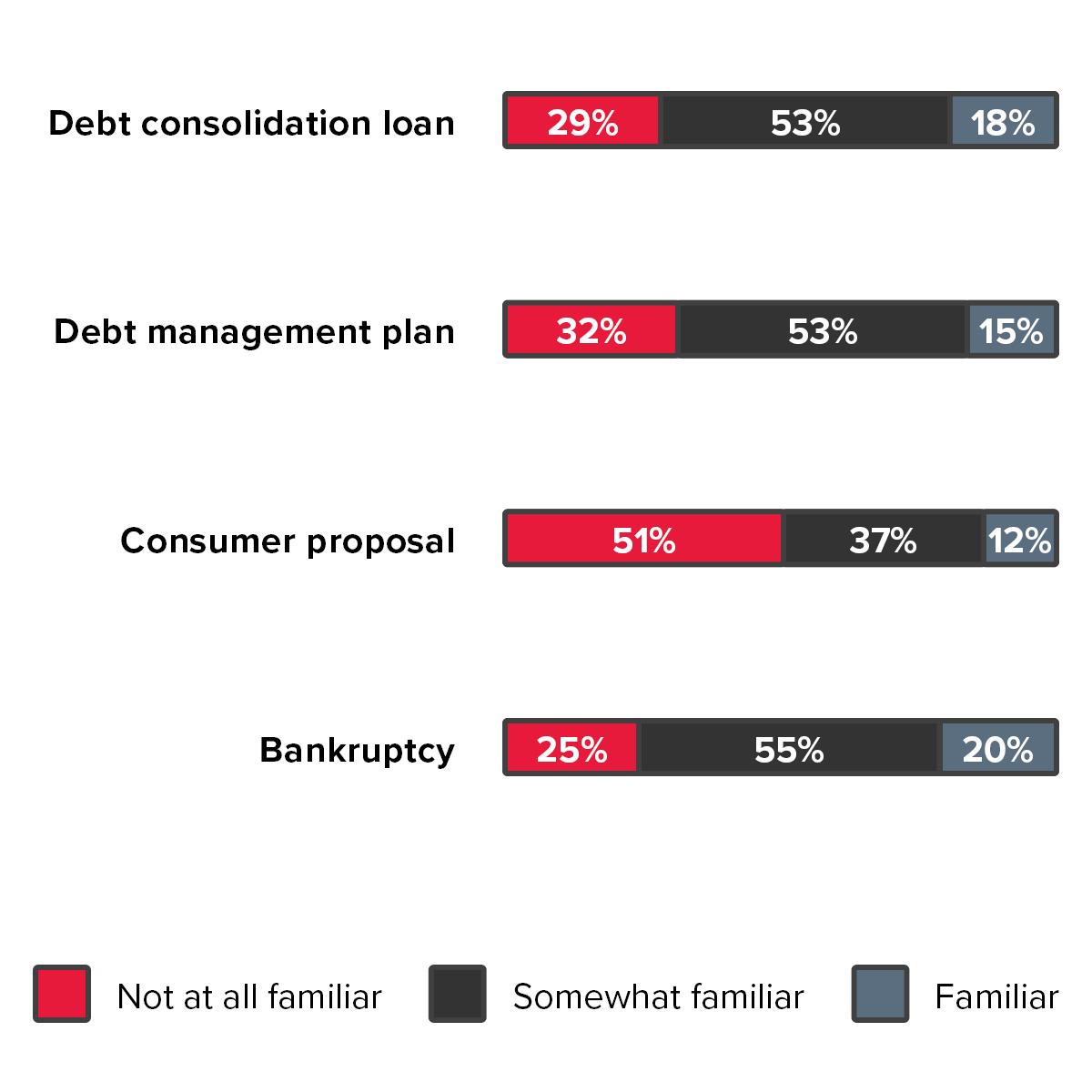

When you can only afford to make your minimum payments, it’s almost impossible to get out of debt. In this situation, you may need to explore debt management strategies that freeze or reduce interest payments or that reduce or erase the debt that you owe.

"Reducing your debt burden is one of the best ways to cope with the affordability crisis. But there’s a hitch, most people are unfamiliar with debt management strategies. Debt is still a taboo subject for many people and is often not talked about with friends and family. It’s why we strongly encourage people to explore their debt relief options. Many households have already cut back as much as they can on their expenses, and not everyone has the time, ability or capacity to take on extra work."

Nancy Snedden, Licensed Insolvency Trustee & President of BDO Debt Solutions

It’s no secret that Canadians carry a lot of debt. The average Canadian owes around $1.80 for every dollar of disposable income.

But how much do they know about the help that is available to them if they are struggling?

Debt can be a huge drain on a household’s income. And when it comes to downsizing expenses, there are similar strategies that can be applied to debt.

Did you know that many Canadians are simply not familiar with the debt solutions that are available to them.

![]()

![]()

![]()

Are you unsure about what to do about your finances? Talking to a Licensed Insolvency Trustee can be a big source of comfort. Book a free, no obligation consultation to learn more about your options.

Talking about money can be uncomfortable & intimidating, which is often enough to prevent you from getting the help you need.

At BDO, we believe that judgement-free, compassionate support goes a long way to making that first step just a little bit easier. We know that debt problems can happen to anyone and there's no shame in seeking help.

Find your local officeIn partnership with BDO Canada, Leger conducted an online survey from April 14 to April 16, 2023, among a representative randomized sample of 1,549 Canadians age 18+. Significance testing is done at a 95% confidence level.